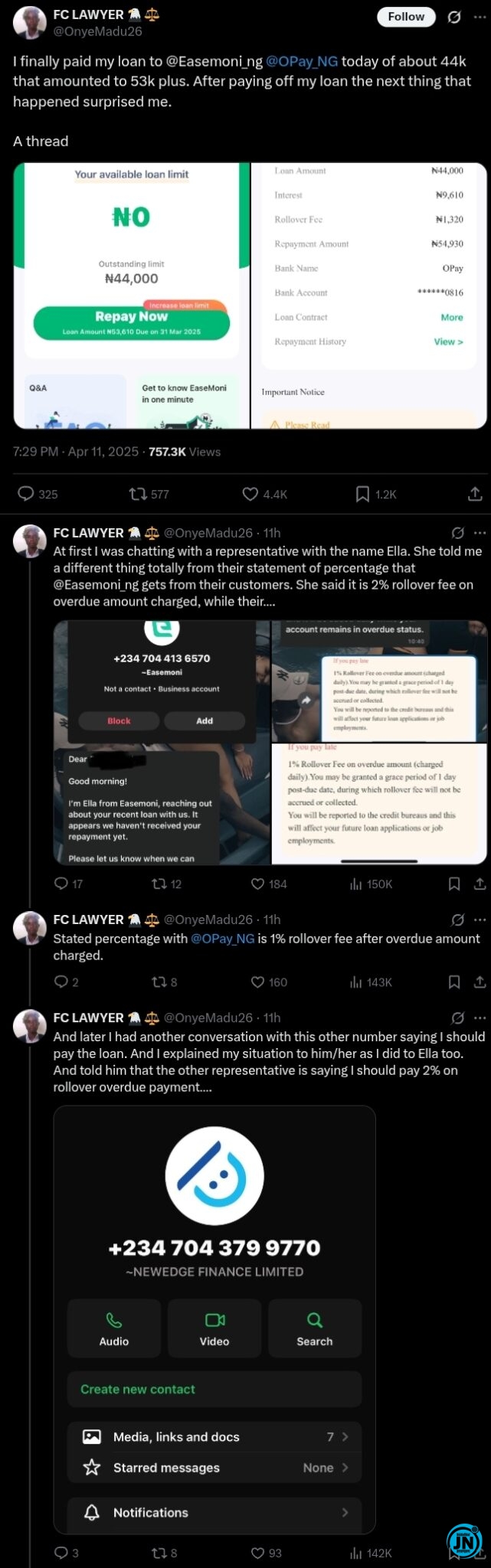

A Nigerian man has publicly slammed the loan app Easemoni_ng for allegedly attempting to trick him into taking on a fresh loan, mere minutes after he had settled an outstanding debt of ₦53,000.

The frustrated customer shared his ordeal in a detailed post on his X (formerly Twitter) account, expressing his shock and anger at what he described as the platform’s manipulative tactics designed to trap users in a cycle of debt.

According to the man, he had initially borrowed ₦44,000 from the app but ended up repaying ₦53,000 after factoring in the accrued interest, which left him financially drained but hopeful to finally put the debt behind him. However, just after clearing the debt, he started receiving conflicting and confusing information from the app's representatives.

The trouble began when he began interacting with a representative named Ella, who gave him unclear and conflicting details about the rollover fees associated with his loan. Ella initially claimed that the rollover fee was 2% on overdue amounts, but when the man checked the policy with Opay, the app’s partner, it clearly stated a 1% fee for such cases. This discrepancy further frustrated him, as the communication seemed intentionally misleading.

As the back-and-forth with Ella continued, the man was contacted by another representative, who insisted that he still had an outstanding payment. The customer, now exasperated, explained his situation once again, only to be met with threats, implying that his debt was not cleared. The man was left feeling cornered and vulnerable. However, after he presented statements from the Federal Competition and Consumer Protection Commission (FCCPC), the representative abruptly backed off, which left him questioning the legitimacy of the app’s practices.

In a previous post on X, the man had shared that he had also reached out to fellow users on the platform for financial help to pay off the overdue loan after eight days of being unable to meet the payment, but unfortunately, no assistance came his way. This left him in a more difficult financial position and feeling abandoned by the very community he had turned to for help.

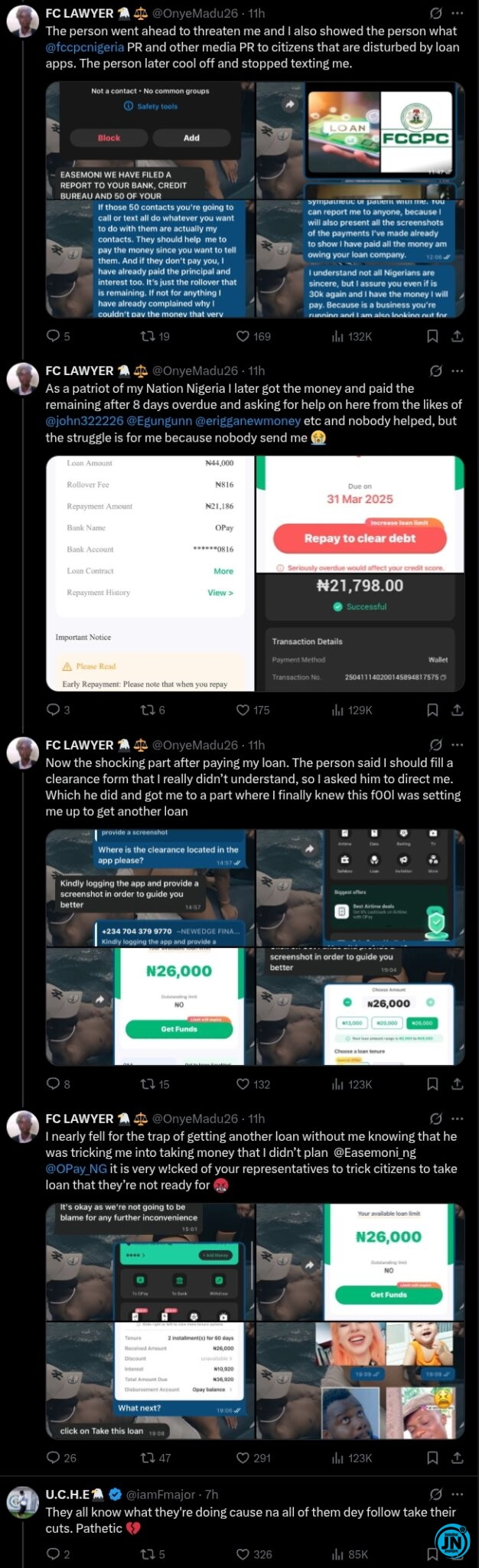

Just when he thought the entire ordeal was finally over, another representative from the loan app reached out, asking him to fill out a “clearance form.” At first, the man thought this was just part of the app’s regular process to wrap up his account. However, upon further interaction, he realized that the form was actually a subtle trick aimed at enticing him into taking out another loan, thus trapping him back into a cycle of debt without his knowledge or consent.

“I nearly fell for the trap of getting another loan without knowing it,” he wrote, clearly frustrated by the experience. He condemned the loan app’s tactics, describing them as “wicked and deceptive,” aimed at exploiting vulnerable users who are already struggling with financial difficulties. He expressed his dismay at how easy it was for the app to almost lure him into making a decision that would have worsened his financial situation even further.

The man ended his post by labeling the loan app and its representatives as “evil,” accusing them of preying on vulnerable citizens and pushing them deeper into financial turmoil through deceitful practices. His words served as a cautionary tale for other users, urging them to be vigilant when dealing with loan apps and to always read the fine print before making any decisions.

SEE POST: